Document Processing and Digital Transformation in Banking & Finance

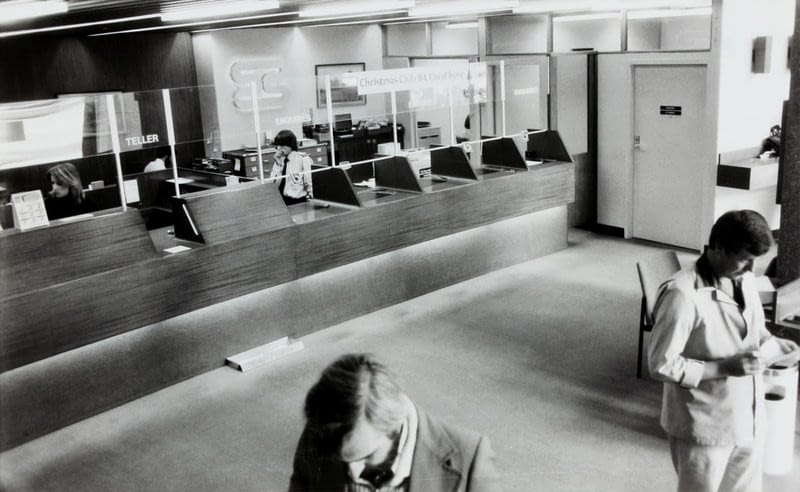

Digital transformation in banking is redesigning the finance landscape right now. It changes how financial services are provided, how payments are made, and how services are delivered in a globalized economy.

The digital revolution is set to create a wave that will, later on, transform the finance industry. As transactions become touchless and automation reaches deeper into finance operations, processes will be radically simplified, and people will no longer be dependent on traditional paper-and-pen technology.

The digital transformation in banking and finance will create new opportunities in the industry as these obstacles and challenges are properly addressed.

Challenges in Document Processing in Banking and Finance

Banking is all about forms.

By nature, banking and finance institutions maintain processes that are primarily focused on documentation and validation. The use of files and documents throughout the entire transaction cycle is crucial. Whether you need to open a bank account or apply for a mortgage, you need to fill out, sign and submit documents. These documents are then subjected to quality and compliance checks to ensure that all relevant data, financial or otherwise, are processed and protected.

Digital transformation in banking offers an immense advantage in getting rid of manual and error-prone processes. However, certain challenges need to be addressed first before completely achieving this transformation.

First, the banking and finance sector is all about paper-based and labor-intensive processes. Even with online forms, a large part of data collection still requires paper documents, from account registrations to loan applications. Then, these paper documents will undergo processing which is mostly conducted manually.

This leads to longer waiting lines, errors in verification, lack of standardization, and waste of resources.

Another problem faced by the industry is the poorly integrated legacy IT systems. The fragmented and outdated systems are incorporated in an ad-hoc manner, causing process breakage and complexity in tracking. This also makes it hard for institutions to reconcile data across systems.

To move forward, financial institutions need to overcome these issues. Digital transformation is an arduous process, and you need a comprehensive solution to accelerate the adoption of these changes.

Achieving Digital Transformation in Banking and Finance Through Automated Document Processing

Robotic Process Automation (RPA) seems to be the best and straightforward solution to document processing challenges in banks and other financial institutions. RPA technology has become a universal enabler in the finance industry these days, and a lot of institutions have started incorporating it into their system.

RPA is generally defined as a business process tool used to automate manual, labor-intensive, repetitive, and rule-based tasks. However, is RPA, in its traditional form, enough to fully resolve this problem?

Although it helps a lot in automating banking processes, enhancements are still necessary to fully support the business strategy.

Aside from RPA, the use of intelligent OCR to digitize and convert unstructured documents into readily available data sources increases efficiency. Remember that most of the documents in the banking and finance sector are on paper. As such, converting physical documents into digital information is a critical first step.

Most OCR software provides basic conversion functions, but you can choose one that combines various technologies to get better results. For instance, artificial intelligence (AI) and machine learning (ML) eliminate tasks that usually need human intervention. Also, natural language processing (NLP) helps make sense of data extracted from paper documents.

These technologies work together to facilitate the quick adoption of digital transformation strategies in the banking and finance sector and allow institutions to enjoy the benefits of this shift.

How Digital Transformation is Changing the Banking and Finance Industry

As mentioned earlier, digital transformation opens up a whole range of opportunities for those in the banking and finance sector. But what exact changes can we expect?

Shorter transaction turnaround times

This doesn’t mean that customers will have fewer forms to fill out or that fewer documents will be processed. However, digital forms allow users to access them anywhere—no need to line up in the bank just to sign up for a loan form. Customers can do it at home to be processed by the bank digitally.

By using intelligent document processing, institutions can easily extract data from these forms for faster turnaround times. The quicker and more accurately these forms are processed, the faster your company or bank can generate profits.

Save on handling and storage costs

Just imagine the amount of space paper documents require for storage. Plus, they need to be stored in a way that will prevent temperature, pests, or acts of nature from damaging them. By switching to digital, all information is stored in the cloud. Institutions can access the data anytime, anywhere.

Minimal error rates associated with manual document verification

Manually typing the information leads to errors. Processing a lot of documents can be tiresome and boring, making the encoder prone to making mistakes. If this happens, document verification will most certainly fail due to inaccurate data entered into the database or system. By sticking with digital forms, the technology eliminates the need for manual document verification and ensures the accuracy of the data submitted to the system.

Process standardization

Digital transformation standardizes the way information is collected from your customers, as well as the type of information gathered. This makes it convenient when processing your compliance.

The Bank Secrecy Act and Anti-Money Laundering risk (AML) regulations have prompted the banking sector to come up with a solution to efficiently manage their risk-and-control frameworks. Manual documents carry a high risk of omission errors and errors of inclusion. By using IDP, banks can improve document processing accuracy and speed while reducing human error.

Less operational risks

By minimizing human errors through the use of IDP, financial institutions significantly reduce the operational risks brought by inaccurate data. You can easily achieve compliance and improve your business processes with the correct data.

Start Your Digital Transformation Journey with DocDigitizer

The first step in digital transformation is to find a suitable agency that would facilitate your company’s transformation. DocDigitizer is in the best position to help you achieve your digitization goals.

DocDigitizer helps banks and financial institutions revolutionize their document processing. The automation data capture service reduces information lead times while increasing the quality of information for its clients. DocDigitizer uses a Cognitive OCR Data Capture Engine for extracting from unstructured documents and Semantic Analysis powered by Machine Learning for contextual semantic information.

Take the first step towards digital transformation with DocDigitizer.